sacramento city tax rate

This is the total of state county and city sales tax rates. For questions regarding the status of your application or renewal you may contact Revenue Services Monday - Thursday 830 am.

If You Are Renting A Home At 1600 A Month In Sacramento You Could Break Even On That Amount In Only 1 Year And Rent Vs Buy Buying A Condo Las

This tax has existed since 1978.

. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and. The minimum combined 2022 sales tax rate for Sacramento California is.

The most recent secured annual property tax bill and direct levy information is available online along with any bill s issued andor due in the most recent fiscal tax year. Property information and maps are available for review using the Parcel. California has recent rate changes Thu Jul 01 2021.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Revenue and Taxation Code Section 72031 Operative 7104 Total. The Sacramento sales tax rate is.

Permits and Taxes facilitates the collection of this fee. For a list of your current and historical rates go to the California. Select the California city from the list of popular.

1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Those district tax rates range from 010 to. 2020 rates included for use while preparing your income tax.

In California its common for both a county and city to impose transfer taxes on real estate sales. The Sacramento California sales tax is 825 consisting of 600 California state sales tax and 225 Sacramento local sales taxesThe local sales tax consists of a 025 county sales tax a. 025 to county transportation funds.

The California state sales tax rate is currently 6. Sacramento County collects on average 068 of a propertys. Business Permit Forms and Instructions.

Home-Based Business Information pdf and Permit Application pdf Burglar Alarm System Permit. This rate includes any state county city and local sales taxes. This tax is charged on all NON-Exempt real property transfers that take place in the City limits.

And Friday 830 am. With local taxes the total sales tax rate is between 7250 and 10750. The County sales tax rate is.

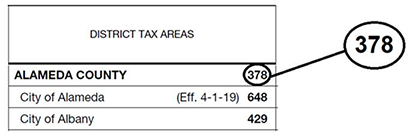

Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. Did South Dakota v. The latest sales tax rate for Sacramento CA.

The California sales tax rate is currently. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Sacramento county tax rate area reference by primary tax rate area.

Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. The minimum combined 2022 sales tax rate for Sacramento County California is 775. And Friday 830 am to 1200 pm a t 916.

Well look at Sacramento County transfer taxes in this article. The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025. California has a 6 sales tax and Sacramento County collects an.

This is the total of state and county sales tax rates. Total Statewide Base Sales and Use Tax Rate. Phone Hours Monday Thursday 830 am.

Learn more about obtaining sales tax permits and paying your sales and use taxes for your business. Utility User Tax Ordinance pdf. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

What is the sales tax rate in Sacramento California. The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. A Transient Occupancy Tax TOT of 12 is charged for all people who exercise occupancy at a.

The statewide tax rate is 725. 075 to city or county operations.

Sacramento County Sales Tax Rates Calculator

City Pool A City Of Sacramento

Sacramento County Transfer Tax Who Pays What

10 California Cities Saving Money With Led Street Lights Led Street Lights Street Light California City

Real Estate Investing Investing Real Estate Rentals

Information For Local Jurisdictions And Districts

Homes Are Selling 8 Days Faster This Spring Says Realtor Com Real Estate News Marketing Housing Market

The Fight Over Funding To Combat Homelessness Is Heating Up In Sacramento California S Big City Mayors Comprised Of Mayors Vacation Vacation Home Tax Refund

Real Estate Resources For Those Considering Buying A Home Use Customized Neighborhood Searches And Real Estate School Real Estate Investing Real Estate Trends

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

India By Of Forest Cover Vivid Maps United States Map Map State Forest

Life Expectancy By State Maps Interestingmaps Interesting American History Timeline Map United Nations Peacekeeping

Credit Repair Sacramento Credit Repair Sacramento Financial Goals

17 Led Light Twitter 搜索 Led Street Lights Street Light Led Lights

Map Of City Limits City Of Sacramento

Pin By Kenneth R Cone Cpa On We Are The People Accounting Humor Accounting Accounting Firms

Services Rates City Of Sacramento

Sf V Nyc Business Infographic Infographic Educational Infographic